Excitement About What Is Trade Credit Insurance

Table of ContentsSome Known Factual Statements About What Is Trade Credit Insurance Getting The What Is Trade Credit Insurance To WorkThings about What Is Trade Credit Insurance

Throughout the year, if any of those purchasers go breast or do not pay, then we will certainly make the repayment. We take a look at the whole turn over of a firm and we underwrite the totality. "What we're seeing via digital systems is that people can browse the web and also can offer a single billing.

What the consumer can after that do is take the selection to guarantee that solitary billing. "At Euler Hermes, we think there's going to be a shift in the means profession credit insurance is dispersed.

Some Known Details About What Is Trade Credit Insurance

Required a broker? See our guide to discovering the appropriate broker.

For instance, a supplier with a margin of 4% that experiences a non-payment of 50,000 would certainly need 25 equal sales to offset a solitary circumstances of non-payment. Credit score insurance coverage reduces against this loss. You can cut investing on debt details as that's covered, and also you won't need to squander sources on chasing collections.

You may have the ability to discuss favourable terms with your distributors as a credit history insurance coverage decreases the influence of an uncollectable loan on them and also potentially the entire supply chain. Credit score insurance coverage exists to assist you prevent and also mitigate your trading threats, so you can create your organization with the knowledge that your accounts are protected.

An organization intended to expand sales with its existing customers but was not completely comfy providing them greater credit score limitations. They spoke to Coface credit insurance policy to cover the greater credit restrictions so they might raise the amount of credit scores used to consumers without risk - my review here What is trade credit insurance. This let them grow i thought about this incomes and deliver even more earnings.

7 Easy Facts About What Is Trade Credit Insurance Explained

"From the first goal of supplying comfort to our banks, the solution added deepness to our business decisions." The interaction enabled the firm to analyze its customers' condition much more accurately as well as has been an important tool in company development.

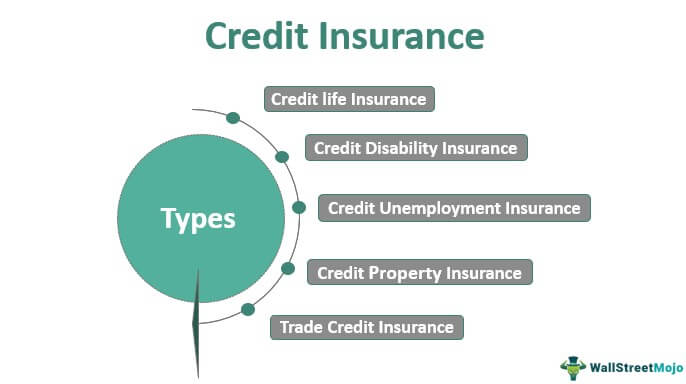

Australian organizations owe around $950 billion to other companies. Which means it's important to have protections in area to make sure that in the event a creditor does not meet its commitments, business can still recover its money. Getting profession credit insurance is one means you can do this. Trade credit history insurance supplies cover when a customer either comes to be insolvent or does not pay its debts after a certain period (which is set out in the insurance coverage policy).

"In the occasion a financial debt is overdue, the policy owner may have the ability to assert as Get More Info much as 90 per cent of the amount of that debt, considering any kind of excesses that may be appropriate," he includes. When it involves gathering the financial obligation, often the insurance firm will certainly have its own debt debt collection agency and will certainly seek the financial obligation in behalf of the company.